-- Will I get results? --

Yes. We know from experience that due to our one on one personal approach, our clients experience tremendous results. The ranges of success are as endless and unique as our clients. We partner with our clients, giving them every advantage they can have in the credit world. Yes, achieving results requires that we work in partnership. Your results will reflect that partnership.

-- How much does bad credit cost? --

The cost of credit repair is small compared to the cost of living with bad credit.

Below are a few examples of the cost of bad credit.

Auto Loan

If you are making vehicle payments, you are most likely paying between $4,000 and $10,000 more over the course of the loan just for having credit score issues. This added interest shows up every month in a higher payment.

Example:

Car Loan

$23,000 Vehicle Financed for 5 Years

| Credit Status |

Rate |

Payment |

Interest Paid |

| High Credit Score |

3% |

$413 |

$1,796 |

| Slightly Damaged |

9% |

$477 |

$5,646 |

| Damaged |

18% |

$584 |

$12,042 |

Home Loan

Damaged credit on a vehicle is nothing compared to the effect of damaged credit on a home loan. A typical home can cost between $180,000 and $300,000 more in interest of the 30 year loan, if you are buying the home with damaged credit. Example:

$120,000 home paid over 30 years:

| Credit Status |

Rate |

Payment |

Interest Paid |

| High Credit Score |

5% |

$644 |

$111,907 |

| Slightly Damaged |

9% |

$966 |

$227,596 |

| Damaged |

11.99% |

$1,233 |

$324,028 |

$190,000 home paid over 30 years:

| Credit Status |

Rate |

Payment |

Interest Paid |

| High Credit Score |

5% |

$1,020 |

$177,186 |

| Slightly Damaged |

9% |

$1,529 |

$360,361 |

| Damaged |

11.99% |

$1,953 |

$513,044 |

Credit Cards

It is not unusual to not be able to get an unsecured credit card with damaged credit. The accounts you may be approved for will typically have higher rates, low credit limits, and have higher than normal penalties and fees for things like late payments.

-- How do you restore bad credit? --

Once we've received your credit reports, we will analyze your credit history to identify items that are responsible for bringing your credit score down. Although we encourage consumers to dispute their own credit if they have the time and knowledge to do so It is important to note that, according to federal law, the credit bureaus can ignore your dispute under a variety of conditions. In our experience, many of the dispute letters sent directly from consumers are rejected for one reason or another. Crossover Credit Solutions LLC has found that by not using form letters we can assure our clients the satisfaction of knowing that the credit bureaus will dispute and conduct an investigation on their behalf.

A disputed credit listing must be verified as accurate for it to remain on the credit report. If the credit listing contains an error, the credit bureau may simply correct the item. Very often disputed credit items cannot be verified because either the creditor no longer possesses the necessary information, or that creditor will not go to the effort of verifying it even if they have the information in question. Furthermore, the investigation must be completed in a "reasonable amount of time" this can be 30-45 days or the listing MUST be removed.

At the conclusion of the credit bureau's investigation, a new copy of the credit report is sent to you along with any deletions or improvements. You then provide us with a copy of the new credit report and the cycle repeats itself at strategic intervals.

-- How long does it take? --

Everyone wants you to see results immediately. Although everyone's credit history is different, most people will see progress within the first 45 days of their membership. The majority of time is spent waiting for the credit bureaus to respond to requests. We take great effort in getting our disputes to the bureaus as fast as possible. As a reference, the average person with 7-10 inaccurate, misleading or obsolete items on each credit report should be prepared for a 3-4 month commitment.

-- What if removed items reappear? --

The FCRA (Fair Credit Reporting Act) has made it much more difficult for a creditor to replace an item once it has been removed. Occasionally, this can happen when a creditor or collection company has re-sold your information for a particular item. This can create what is known as a "soft delete." As an active client of Crossover Credit Solutions LLC we will re-challenge the item with the full force of the prior removal in your favor.

-- Is this legal? --

Yes, you are given the right under the Fair Credit Reporting Act (FCRA), including the right to challenge inaccurate, misleading and obsolete items appearing on your credit report. Crossover Credit Solutions LLC uses every venue available to you under the law to help you assert these rights.

-- How is this done legally? --

Disputing items on your credit report is your legal right (see the Fair Credit Reporting Act). When you use Crossover Credit Solutions LLC to help repair your credit, we are abiding by and using all federal and regional laws regulating third party credit repair assistance.

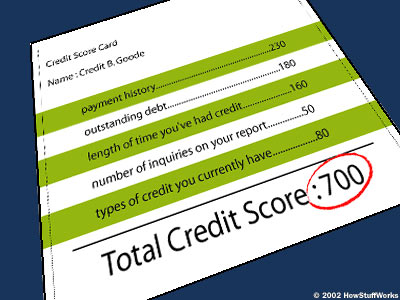

-- What is a credit score? --

A credit score is a numerical ranking system that lenders use to determine how much of a credit risk you are. A credit score is a numeric indication of how likely you are to repay debts such as loans or lines of credit. Lenders use this number to determine how much of a credit risk you are.

Credit scores also are designed to indicate your creditworthiness in comparison with other consumers.

Credit scores are based on the data in your credit report and are generated by computers using artificial intelligence. Usually a credit score is between the numbers 350 to 850. The higher your score, the more "creditworthy" you are to lenders.

-- What is my credit score based on? --

Credit scoring is based on many factors that may include:

Amount of available credit

Payment history

Recent requests for credit

Amount of credit currently being used

Length of credit history

Under the Equal Credit Opportunity Act, credit scoring may not use gender, martial status, national origin, race, or religion as factors.

-- How can negative credit records be deleted? --

Negative credit records are deleted from consumers' credit reports each and every day!

Crossover Credit Solutions LLC is hard at work every day challenging damaging and questionable credit entries on behalf of its clients. Utilizing proven and absolutely legal methods, Crossover Credit Solutions LLC is a professional organization working for you and your credit profile.

-- I'm ready to sign up right now. How do I do it? --

It all starts with a credit assessment, which you can get by visiting our Start Now page or calling us at 214-387-4389. We're different from our competition in that every one of our clients receives individual attention from Crossover Credit Solutions LLC. We formulate a customized plan of action based on your specific needs. No two clients are alike!